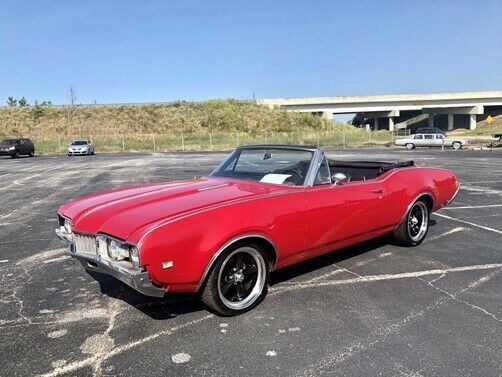

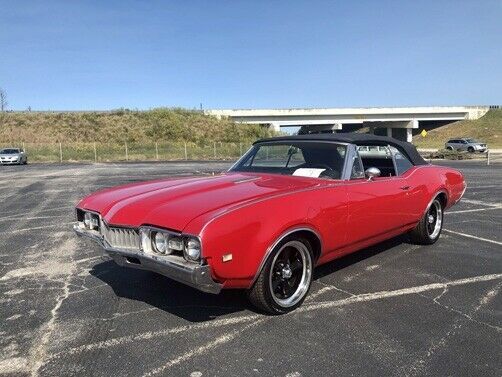

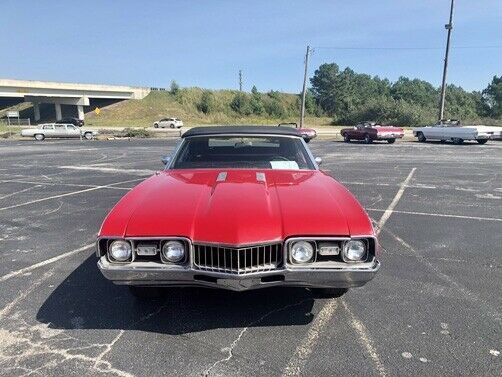

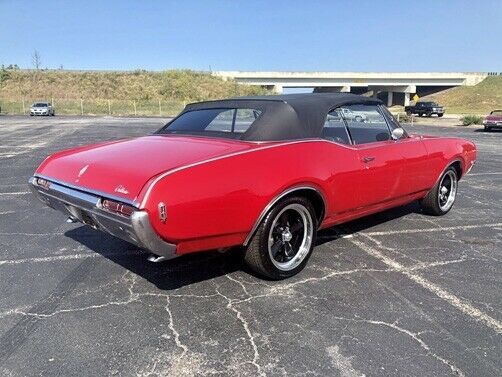

1968 Oldsmobile Cutlass 46902 Miles Red/Black

Technical specifications of Oldsmobile Cutlass 1968

| Price: | US $19,988.00 |

|---|---|

| Condition: | Used |

| Make: | Oldsmobile |

| Model: | Cutlass |

| Type: | -- |

| Year: | 1968 |

| Mileage: | 46902 |

| VIN: | 336678M435299 |

| Color: | Black |

| Engine size: | -- |

| Power options: | -- |

| Fuel: | Gasoline |

| Transmission: | -- |

| Drive type: | -- |

| Interior color: | -- |

| Options: | -- |

| Vehicle Title: | -- |

| You are interested? | Contact the seller! |