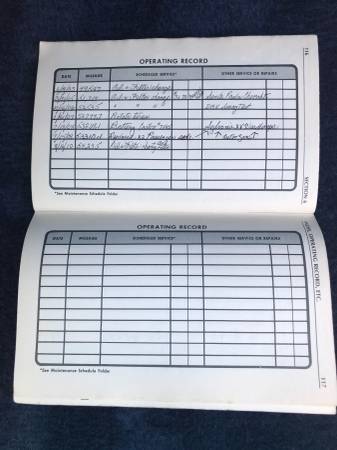

1984 Oldsmobile Cutlass Supreme All Original - One Owner

Technical specifications of Oldsmobile Cutlass 1984

| Price: | US $10,000.00 |

|---|---|

| Item location: | Ojai, California, United States |

| Make: | Oldsmobile |

| Model: | Cutlass |

| SubModel: | Supreme |

| Year: | 1984 |

| Mileage: | 58,000 |

| VIN: | 1G3AR47A2EM342680 |

| Color: | Blue |

| Number of cylinders: | 6 |

| Fuel: | Gasoline |

| Interior color: | Blue |

| Vehicle Title: | Clear |

| You are interested? | Contact the seller! |